Notes from ‘YP: On the Money Financial Literacy Series: Understanding your Credit’

As a new member of the Urban League of Greater New Orleans Young Professionals (“ULGNOYP”), I recently attended the event YP: On the Money Financial Literacy Series: Understanding your Credit. The guest speaker was Ms. Patricia Hightower, president and CEO of Bayou Equity Mortgage.

Ms. Hightower shared valuable information about understanding your credit score and how to improve it overall — and to meet specific goals (homeownership, business loan approval, paying off student loans, etc.).

Here are my notes from the session (including additional research I did at home):

Understanding Credit Scores & Credit Reports

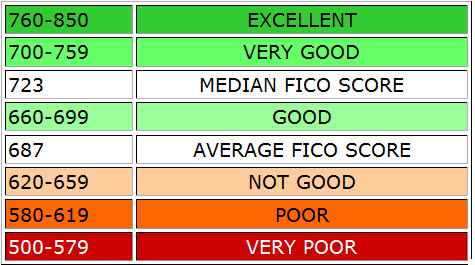

Ms. Hightower shared that credit scores commonly range from 300 to 850. Most lenders prefer FICO scores above 640. This is usually the case if you want to purchase a home. 620 is sometimes accepted but 640 and up is better. Lenders believe that the higher your credit score, the lower the risk.

Credit Score Breakdown*

Excellent credit score: 720 and Up

Credit scores in this range will open up the best interest rates and repayment terms for loans. If you want to make major purchases, such as an investment property, this credit score range is where you want to be.

Good credit score: 680 to 719

A credit report score in the 680-and-up range is good news for you. You can still get decent terms from lenders, although not as nice as those offered to borrowers with truly excellent credit scores. If you’re shopping for a first home, a score in this range is certainly considered to be a good credit score, and it will get you an acceptable mortgage. You’ll likely also be able to refinance your mortgage for better terms on an existing payment structure.

Average credit score: 620 to 679

This is the absolute minimum credit score you can carry and still get fair mortgage terms. Smaller-ticket items that require financing are doable in this range, which is several notches below a good credit score. However, you’ll be better served by reviewing your credit history report and taking steps to improve your credit score.

Poor credit score: 580 to 619

Although you won’t necessarily have any problems getting loans with a credit report score in the high-500 to low-600 range, you’ll get those loans on lenders’ terms. Be ready for higher interest rates, and expect finance charges that will hit you right in the wallet. The good news is that you can build your credit score from here by monitoring your credit reports and by being responsible with your finances. Note that this range is also the lowest workable credit score range if you’re shopping for auto financing.

Bad credit score: 500 to 579

If your credit falls somewhere in this credit score range, financing terms will cost you big-time. For long-term loans, such as a 30-year mortgage, expect to see interest rates that are at least three percent higher than interest rates awarded to borrowers with good credit. For shorter-term loans, like a 36-month auto loan, the effects of your bad credit score are even more pronounced. Expect interest rates almost double those offered to consumers with good credit scores.

Miserable credit score: Less than 500

At this point, your credit score is so bad that getting any type of financing is almost impossible. If you can get loans, they’ll carry nearly punitive interest rates. If your credit report score is below 500, it’s time for action. Get a copy of your credit history report, and make an appointment with a credit counselor.

To lenders, unfortunately, all your other positive qualities (including work history and professional references) mean very little if you have a low credit score. However, no score says whether a specific individual will be a “good†or “bad†customer. There is no single “cutoff score†used by all lenders and there are many additional factors that lenders use to determine your actual interest rates. But to cover your bases, it’s always best to play it safe and strive to attain and maintain the highest credit score you can (tips on how to do this are further down in my notes).

Credit scores are often called FICO scores because most credit bureau scores used in the U.S. are produced from software developed by FICO (Fair Isaac and Company). But it’s important to understand that not every credit score you can buy online is a true FICO score. A FICO score is the most widely used credit score, created by Fair Isaac Corporation. Lenders use the FICO score to help them make billions of credit decisions every year. Fair Isaac calculates the FICO score based solely on information in consumer credit reports maintained at the credit reporting agencies.

Keep in mind that your credit score does not factor in things like paying your rent and utilities on time. It will, however, factor in if your utility providers send you to collections for outstanding balances (same if the rental company or your landlord reports to credit agencies that you are late on your rent payments). Your FICO Score considers both positive and negative information in your credit report. Late payments will lower your FICO score, but establishing or re-establishing a good track record of making payments on time will raise your score.

A credit score is a numerical expression derived from a statistical analysis of a person’s credit files. A credit score is used to represent the creditworthiness of that person, which is the likelihood that the person will pay his or her debts in a timely manner. A credit score is primarily based on credit report information which is typically sourced from credit bureaus / credit reference agencies. Higher scores are considered better.

This system was developed by lenders, such as banks and credit card companies who use credit scores to evaluate the potential risk posed by lending money to people and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Other organizations, such as mobile phone companies, insurance companies, employers, and government departments have begun to employ the same techniques.

A credit report contains all of the detailed information in person’s credit file maintained by a Credit Bureau. Think of it as an accumulation of information about how you pay your bills and repay loans, how much credit you have available and what your monthly debts are that could be provided by the Credit Bureau in a consumer report to a third party, such as a credit card company or a lender. The data in a credit report is interpreted through a complex mathematical process to determine a credit score, which is a single number.

When lenders order your credit report, they can also buy a credit score that’s based on the information in the report. A credit score helps lenders evaluate your credit report because it is a number that summarizes your credit risk, based on a snapshot of your credit report at a particular point in time.

Your credit score influences the credit that’s available to you and the terms (interest rate, etc.) that lenders offer you. It’s a vital part of your credit health. When you apply for credit – whether for a credit card, a car loan, or a mortgage – lenders want to know what risk they’d take by loaning money to you.

Your credit score is calculated from your credit report. However, lenders look at many things when making a credit decision including your income, how long you have worked at your present job and the kind of credit you are requesting.

The Ten Biggest Credit Mistakes

Ms. Hightower shared ten common mistakes that negatively impact your credit score, making it difficult to for you to gain employment (most companies run credit checks on potential employees these days), secure a personal or business loan, establish a line of credit, purchase a home or vehicle and more. Some of these mistakes are probably already on your radar, but a few were things I never considered before …

1. Missing Payments

Credit Scores are based on your credit history. Past and current accounts are reviewed in order to predict how likely you are to miss payments in the future. Missing payments will hurt your credit score.

2. Closing Credit Card Accounts

A common misconception is that closing credit card accounts will increase your credit score. There are many reasons you should not close credit cards that you no longer use. Some consumers think that closing a credit card that is past due will make the delinquency go away, which is not the case.

3. Settling debt on a past due Account

“Settling†means accepting less than the amount you owe on an account. Some lenders may negotiate with consumers for a fee that is less than what the consumer owes but are willing to accept it in lieu of getting nothing at all. While this may seem like a good idea, be aware that the lender will report the remaining amount to the credit bureaus as a negative balance.

A deficiency balance is considered just as negatively by credit scoring models as other severe late payments. However, settling a debt is better than ignoring the debt and not making any payments at all.

4. Incurring High Balance too Close to your Limit

Thirty percent of the FICO score looks at the amount owed compared to the amount of available credit. Having high balances on your credit cards will inevitably cause your credit scores to decrease dramatically.

5. Excessively Shopping for Credit

Applying for credit causes a hard inquiry on your credit report. An inquiry is a record of who pulled your credit report and on what date. Consumers who have more inquiries are higher credit risks than consumers with fewer inquiries.

6. Thinking that all credit scores are the same …

A common misconception is that there is only one credit score. In reality there are many different credit scores used by lenders. There are even some check approval services that develop risk models and scoring that are based on check writing patterns, in order to predict the risk of a particular check being returned.

7. Thinking that all Credit Scores Predict the Same Thing

There are many different models that predict things other than general credit risk. Scoring models have been built to predict many things.

8. Not Knowing Your Rights Under The Fair Credit Report Act

The Fair Credit Reporting Act is a federal law that regulates collection, dissemination, and use of consumer information, including consumer credit information. You have rights under the FCRA that you should familiarize yourself with, and are available on the Federal Trade Commission web site, www.ftc.gov.

For example, it is your right to get one free credit report per year. You can access your credit score today at https://www.creditkarma.com/. Credit Karma provides users with their TransRisk New Account Score, VantageScore, and Auto Insurance Score as supplied by TransUnion. Credit Karma is not a credit bureau or credit reporting agency. They do not maintain or calculate your score. They simply act as your agent in retrieving your score from a Credit Bureau. Inquires made on your behalf will not be shown to creditors and will not affect your credit score.

The TransRisk score is calculated by TransUnion using their proprietary scoring model and is the original credit score provided on Credit Karma.

The VantageScore is calculated by TransUnion using the VantageScore model, developed jointly by all three major credit bureaus. This model introduces the first, consistent scoring methodology shared by all three bureaus. The Auto Insurance Score is a numerical measurement of the risk a consumer may pose to an insurance company. This score is calculated from data derived from a consumer’s credit report.

At www.annualcreditreport.com, you can get your credit reports from all three bureaus at once. By law, you have the right to access one free credit report per year, per agency. Don’t use an old credit report to assess your credit. Credit reports don’t always have your credit score, but they do have your credit history. I recommend you check both annualcreditreport.com and creditkarma.com to get the complete picture.

9. Not Knowing That You Have Three Credit Reports & Three Credit Scores

Many consumers do not know that they have three credit reports compiled and maintained by three separate & competing companies called credit reporting agencies. These companies are essentially warehouses that store your credit history and sell it to lenders who may or may not grant you credit.

If you want to be extra thorough, you can individually contact each of the three major credit bureaus and get a credit report from each of them, but usually your free Credit Karma report is enough to get you started on your path to improving your credit score.

The Three Major Credit Bureaus

Here’s how to contact the three major credit bureaus to ask about or obtain your credit report or credit score, alert creditors to a possible fraud using your name, or for any other reason:

Equifax: 800-685-1111 (general) or 800-525-6285 (fraud); P.O. Box 740241, Atlanta, GA 30374;Â www.equifax.com

Experian: 888-397-3742 (general and fraud); PO Box 2002, Allen, TX 75013, www.experian.com.

TransUnion: 800-888-4213 (general) or 800-680-7289 (fraud); P.O. Box 2000, Chester, PA 19022;Â www.transunion.com.

The FICO score has a different name at each of the credit reporting agencies. All of these scores, however, are developed using the same methods by Fair Isaac.

Each bureau is required by law to give you one free credit report per year. Keep in mind that your credit score isn’t usually included on the free reports — you can pay extra for that, or just check it for free on creditkarma.com. But you need both your credit report(s) and credit score to effectively evaluate how to pay down all your debts and improve your credit score.

10. Not Having Credit

If a credit file does not have enough information to generate a credit score, it is often called a “thin file.†Using credit responsibly is the best way to ensure a solid credit score. In some cases, you can have someone (like a parent, legal guardian, or trusted friend/family member) co-sign on a card with you to help you build your credit (make sure they are trustworthy!).

Taking Control Of Your Credit: Ten Things To Consider

You CAN improve your credit score by learning how to understand your credit report, creating a plan of action and sticking to it. Some people can dramatically improve their credit score within a year, so be patient and access as many resources as you can to stay on track.

Obviously if you don’t have a job or any money, improving your credit score is the least of your concerns (although unfortunately a low credit score can prevent you from being hired at many companies, renting an apartment, etc.). These notes assume that you have at least some income and at least $100 additional dollars a month to set aside toward paying down your debt(s). There are nonprofits dedicated to helping people take control of their credit scores, so even if you are unemployed or financially struggling, it’s worth it to see what your options are.

As you prepare your plan of action, consider these points:

1. The first thing any lender wants to know is whether you’ve paid past credit accounts on time. This is one of the most important factors in a FICO score. Make it a priority to negotiate your payment plan to a solution that results in you being able to send each payment ON TIME. This may not be possible with every outstanding balance, but it doesn’t hurt to try.

2. In general, a longer credit history will increase your FICO score. This means your credit score will improve over time, so be sure to use a credit card on a regular basis in a FINANCIALLY RESPONSIBLE way: make small purchases every month that you pay off on time (gas for your car, groceries, etc.). If you can, also use your credit card for larger purchases (that you pay off on time), but you’d be surprised how much you can improve your credit score by paying off those regular small purchases (on time every month). However, even people who haven’t been using credit long may have a high FICO score, depending on how the rest of the credit report looks.

3. If you don’t have a credit score yet or have a decent to great credit score and want to improve it in order to meet a lending goal (like being eligible for a home loan), establish at least three types/lines of credit and make sure to pay your balances on time. This can be a credit card, a retail account like a Macy’s card, installment loans with a bank (like a car note), a mortgage, etc. BUT BEWARE: research shows that opening several credit accounts in a short period of time represents a greater risk – especially for people who don’t have a long credit history.

So if you’re just starting to build your credit, don’t go overboard and suddenly apply for every credit line you can. Pace yourself.

4. Ultimately, reducing your debt won’t work if you don’t create a spending plan that allows you to live within your means and pay down your debt at the same time. A spending plan or budget is a critical to improving your credit score.

5. There are two primary forms of debt: secured debt (e.g., mortgage debt or car loans) and unsecured debt (e.g., credit card debt). A good credit counselor will review your secured debt and your unsecured debt. The goal will be to first stabilize your financial life at home and make sure you can eat, keep the lights on and pay your rent or mortgage. Then, your counselor will look at how to best deal with your credit card debt.

6. A DMP is a payment plan negotiated with the credit card company by a nonprofit consumer counseling company to help you get out of debt. In most cases, the DMP will do the following:

-

It will give you a five-year plan to get your debt paid off completely.

-

It will lower your interest rate on your credit card debt (or unsecured debt)—usually to less than 10 percent. In many cases, companies will lower the rate to 0 percent interest, provided you pay the bills on time.

-

It will end the over-the-limit fees and annual credit card fees you are being hit with.

-

It may waive your late fees on credit cards.

-

The nonprofit organization will pay your bills for you (once you send the money to them), and they will show you proof of your debt being paid down.

-

The credit card company may or may not report your account as being on a DMP to the credit bureaus, and it can affect your credit score.

-

You may be asked to sign a DMP agreement making the payment plan terms official. Read this in detail before you sign it.

7. Find a nonprofit credit counseling organization that is affiliated with one of two major credit counseling membership organizations. These two member organizations will refer you to a credit counselor in your area that you can work with. Both organizations worked with millions of people last year, so trust me, they have seen it all.

National Foundation for Credit Counseling (NFCC)

-

Toll-free: 800-388-2227

Association of Independent Consumer Credit Counseling Agencies

-

866-703-8787

8. Any nonprofit credit counselor who is honest and worth trusting won’t do the following:

-

They won’t pressure you to sign up.

-

They won’t charge you a huge sign-up fee. In most cases, the sign-up cost for a nonprofit credit counseling organization is $75 (and maybe less).

-

They won’t charge you a huge fee each month. In most cases, the monthly fee for a nonprofit consumer counselor is $50 or less.

-

They won’t tell you to stop paying your credit card debt or other debt so he can negotiate a better deal for you.

-

They won’t tell you he can sue the credit card company on your behalf.

-

They won’t recommend a DMP first, before he really looks at your overall financial picture.

9. IMPORTANT: Although the Fair Credit Reporting Act states that each consumer is eligible for one free credit report from each credit bureau per year, this does not include tri-merge reports. A tri-merge credit report is a report that contains the data from all three of your credit reports combined into one. You can purchase a tri-merge credit report from any of the three credit bureaus– Experian, Equifax or TransUnion.

Keep in mind that the credit scores provided with any tri-merge credit report you purchase are only “educational” scores. They are not the same scores used by lenders (so make sure you know what your true score is before you approach a lender for big purchases like a car or home). You may purchase your actual Equifax and TransUnion scores from myFICO.com. Experian no longer sells scores to individuals.

What you get from a free source like Credit Karma is NOT a tri-merge report but is enough for you to assess the general state of your credit and take steps to improve your score.

10. Use a monthly spending plan worksheet and calculator to create a budget that you can stick to—and save with—every paycheck. Here’s an example.

Want To Purchase A Home? Don’t Forget These Three Tips

1. Make sure that during the time that your credit is being pulled by potential lenders, that you are using 50% or less on each of your credit line limits. 30% or less is ideal, in general.

2. Use your older credit cards and pay them off first.

3. Limit the amount of credit inquiries to as little as possible (don’t start applying for new lines of credit if you can help it).

These three tips are useful to anyone looking to improve their credit, but are essential to would-be homebuyers.

Improve Your Credit Score: A Sample Plan

1. Get your credit score from the past year (ex: creditkarma.com). Their dashboard shows you some details from your credit report, but it’s best to get the actual reports from the bureaus themselves.

By law, you have the right to access one free credit report per year from each bureau (but they don’t include your credit score – you can pay extra to have them included if you want, or just reference the score on creditkarma.com). Don’t use an old credit report to assess your credit history. At annualcreditreport.com you can get reports from the three major national credit bureaus at once, for free (once a year).

Remember that knowing your credit score alone won’t help you figure out how to improve the score — you need your credit report(s) too.

2. Review that the information in your credit report(s) is accurate and address any errors or issues. Verify that things like your social security number, date of birth, home addresses from the past 7-10 years, credit accounts, inquiries and more are accurate. Reviewing these things are essential and can help you determine if your identity has been stolen.

3. Pay down your balances. Access a credit counseling service to help you with things like creating a budget and action plan, consolidating your payments and more.

4. Dispute any incorrect information on your credit report. This is not optional; the longer you wait, the more this can potentially harm/lower your credit score.

5. Reduce your installment loans to less than 10 months remaining. This will demonstrate to lenders that you are reliable.

6. Use your credit card to buy low priced items and pay them off every month (gas, groceries, etc.).

7. Reduce (as much as possible) your outstanding long term debts (ex: car payment).

8. Commit to making your loan or outstanding balance payments on time. Set alerts on your phone and create a calendar of payments. Set up automatic withdrawals from your checking account, if you can. Don’t forget to make payments on time; this is critical to improving your credit score.

9. Do not borrow more than 50% on each credit card at a time. You don’t want it to appear to lenders that you are living beyond your means. You also, in general, should try not to spend more each month than you actually make in income.

10. If you have no credit or bad credit and can’t get a regular credit card, apply for a secured credit card and start building your credit with that.

A secured credit card requires you to make a deposit against the card’s credit limit. Your credit limit will usually be a percentage of your security deposit or it may be the same as your deposit (ex: you put in a $500 deposit and then your secured credit limit is $500). Many banks place your deposit into an interest-bearing savings account where it stays until you close your account, upgrade to an unsecured credit card, or default on your credit card balance.

Secured credit cards act just like regular credit cards. Purchases reduce your available credit and you’re required to make monthly minimum payments on your balance. If your secured credit card has a grace period, you can avoid paying finance charges by paying your balance in full each month. Late payments and over-the-limit transactions are penalized with a fee.

Some secured credit cards review your account after a certain amount of time, e.g. 12 months, and upgrade you to an unsecured credit card if you qualify. You can improve your chances of qualifying for an unsecured credit card by making your payments on time and keeping your credit card balance low. Even if your secured credit card issuer doesn’t upgrade you to an unsecured credit card, you may qualify for an unsecured credit card with another credit card issuer after six to twelve months. That’s assuming your secured credit card has reported your credit history to one of the major credit bureaus.

11. Address any charge offs (when a creditor sells your debt to a collection agency), judgements (public record items usually tied to property), collections (delinquent balances) and liens (usually tied to unpaid bills pertaining to property you own) on your credit report ASAP. Those are the biggest red flags that lenders and potential employers look at.

12. Don’t stop paying down a debt to demonstrate hardship. This is one of the mistakes that MANY people make. To settle (paying a smaller sum at once than the true balance) is even better than to have a debt just sitting there for more than 30 days. Do whatever you can to start making any kind of payment at all on all your debts, especially those on your oldest lines of credit or bills that have gone to collections.

13. Document your payment arrangements EVERY TIME. In fact, document all pertinent details every time you call a collection agency/creditor. Track the date and time of the call, the name of the person you spoke with, your payment agreement, etc. Make a paper trail. If you can get an email address and/or a summary of the agreement emailed to you, even better. You will need these details to address issues on your credit report.

14. Track down and get copies of all your paid in full letters. Sometimes creditors don’t report to the credit bureaus when you have paid off a debt, or they will report it many months later.

You have the power to update your credit report if you have a copy of your paid in full letter. Whenever you have an account paid in full, send a copy of the paid in full letter to each of the three bureaus; they must update your credit report in 30 days, by law.

15. Maintain three credit accounts (ex: credit card, care note, student loan) if you plan on ever purchasing a home or large equivalent purchase.

16. Accurately report your debts on any credit applications or job applications. This information is readily accessible so lying about it may just cause you more problems.

17. Don’t apply for any new credit cards while attempting to purchase any large items on credit.

18. Keep in mind that medical bill collections are not looked at when applying for an FHA loan, but do try to address any medical bills as much as you can because they affect your credit score as well.

There isn’t a one-size-fits-all credit-building solution that will work for everyone, but hopefully my notes help you figure out what makes sense for you.

You can improve your credit score in as few as three to six months (or even more quickly, if you discover that some of the errors being reported aren’t really your own). Many folks can bump their credit score into the good to great range within a year. Generally speaking, your actions will begin to positively affect your score in 30 to 60 days.

I really enjoyed my first financial literacy seminar through ULGNOYP. Ms. Patricia Hightower was an excellent speaker and I appreciated her thoroughness. She made the process of understanding my credit report and the options I have for improving my credit score clear and accessible.

I’m looking forward to the next financial literacy seminar in the series and will again share my notes.

ABOUT ULGNOYP

ULGNOYP is an Urban League of Greater New Orleans auxiliary of young professionals committed to promoting and supporting the ideas and goals of the Urban League movement throughout the New Orleans area through community outreach, fundraising and membership development.

Their monthly financial workshop series is free and open to the public.